KEY PROGRAMS

Regulatory Compliance

Verdani partners with you to simplify ESG compliance, protect against regulatory risk, and unlock new opportunities in a rapidly shifting global market.

As regulatory experts and trusted advisors, Verdani works with clients to meet disclosure requirements while integrating them into their broader business strategy.

The expanding web of global ESG regulations can feel overwhelming. Verdani makes it simple by translating complex requirements into clear, actionable strategies that protect your investments, build resilience, and position you for success in an evolving global landscape.

Regulatory Reporting

Verdani’s experts monitor, interpret, and streamline regulatory requirements into clear strategies tailored to each client.

Today’s sustainability landscape is rapidly evolving, driven by global trends such as climate risk and governance reporting, GHG emissions disclosure, transition planning, and harmonization with global standards. With thousands of regulations and frameworks — from California’s SB 253 and SB 261 to the EU’s CSRD and SFDR, plus voluntary programs like GRESB and PRI — reporting is more complex than ever. We align reporting with leading frameworks like TCFD, IFRS, and SBTi, helping organizations reduce overlap, minimize risks, and deliver credible, investor-ready disclosures. Our iterative approach fosters continuous improvement, turning complex regulations into actionable sustainability performance.

Climate Risk

& Governance Reporting

Performance

& Transitions Plans

GHG Emissions Reporting

(Scopes 1-3)

Harmonization

with Global Standards

U.S. & Global Regulations

Global ESG regulations have increased by 155% over the past decade. This map highlights key regulatory themes across the world.

Regulatory Reporting Services

Even as federal action in the U.S. slows, momentum continues at the global, state, and local levels — making it critical for organizations to stay proactive. Verdani supports clients across this diverse regulatory landscape, including:

United States

-

Companies with > $1B in annual revenue doing business in CA

Disclose scope 1 and 2 GHGs annually starting June 2026*; scope 3 GHGs in 2027

Up to $500,000 penalty per year

Policy type: GHG Emissions / Performance & Transition Plan

-

Companies with > $500K in annual revenue doing business in CA

Disclose climate-related financial risks biennially starting Jan. 2026

Up to $50,000 penalty per year

Policy type: Climate Risk & Governance / Performance & Transition Plan

-

Companies in CA making emissions claims and using or marketing voluntary carbon offsets

Disclose emissions claims and use/sale of carbon offsets annually starting Jan. 2025

$5,000 per day per violation, capped at $500,000

Policy type: Performance & Transition Plan

-

Real estate assets located in various state/city jurisdictions in the U.S.

Meet energy efficiency/emissions reduction requirements

Penalties dependent on jurisdiction

Policy type: GHG Emissions / Performance & Transition Plan

-

Investment advisors registered with the SEC and companies marketing ESG-focused funds

Ensure all marketing material (e.g. annual reports) are free of potentially misleading (i.e. greenwashing) information

Policy type: Climate Risk & Governance

Global

-

Real estate assets located in certain EU member states

Meet minimum energy performance requirements via EPCs; non-residential by 2027 and residential by 2030

Penalties for worst-performing fractions of the building stock

Policy type: GHG Emissions / Performance & Transition Plan

-

Financial market participants and advisors marketing products in the EU

Disclose sustainability risks and impacts at entity and product level

Penalty enforcement varies by EU member state

Policy type: Climate Risk & Governance / Performance & Transition Plan

-

FDR Article 8 and 9 funds; large companies in scope of CSRD

Disclose share of activities aligned with the EU Taxonomy’s criteria for environmentally sustainable activities

*Disclosure date subject to CARB’s final guidance, expected Dec. 2025. Current timeline anticipates first reports due June 2026.

**EU Taxonomy is a classification system mandated under SFDR/CSRD, not a standalone disclosure regulation.Investor & Regulatory

Ad Hoc Support

Institutional investors, boards, and regulators are increasing their expectations for rapid, data-backed ESG disclosures. These requests often fall outside normal reporting cycles but demand accuracy, speed, and credibility.

Verdani’s Role

Verdani provides high-quality responses to “surprise asks” from limited partners , boards, and regulators, supported by ESG, reporting, and regulatory experts who understand real estate portfolios and disclosure frameworks.

Value to Clients

Fosters investor confidence, maintains compliance readiness, and reduces internal burden by providing reliable, expert partnership when timing and accuracy matter most.

How We Help

Verdani supports clients in meeting evolving investor and regulatory disclosure requirements with clarity and confidence. Our experts align sustainability narratives and metrics with GRESB, PRI, IFRS S1/S2, CSRD, and SEC frameworks — streamlining responses, strengthening QA/QC, and providing proactive insights into emerging disclosure trends.

California Climate Disclosure

With the first deadline of January 1, 2026, the time to act is now!

More than 4,000 public and private companies are expected to be in scope of California's new climate disclosure laws, CA SB 253 and SB 261. Companies must disclose climate-related financial risks and greenhouse gas emissions. Inaction is not an option: businesses must determine regulatory exposure, evaluate climate-related financial risk, gather environmental data, educate stakeholders, and engage third party experts to avoid compliance and reputational risk.

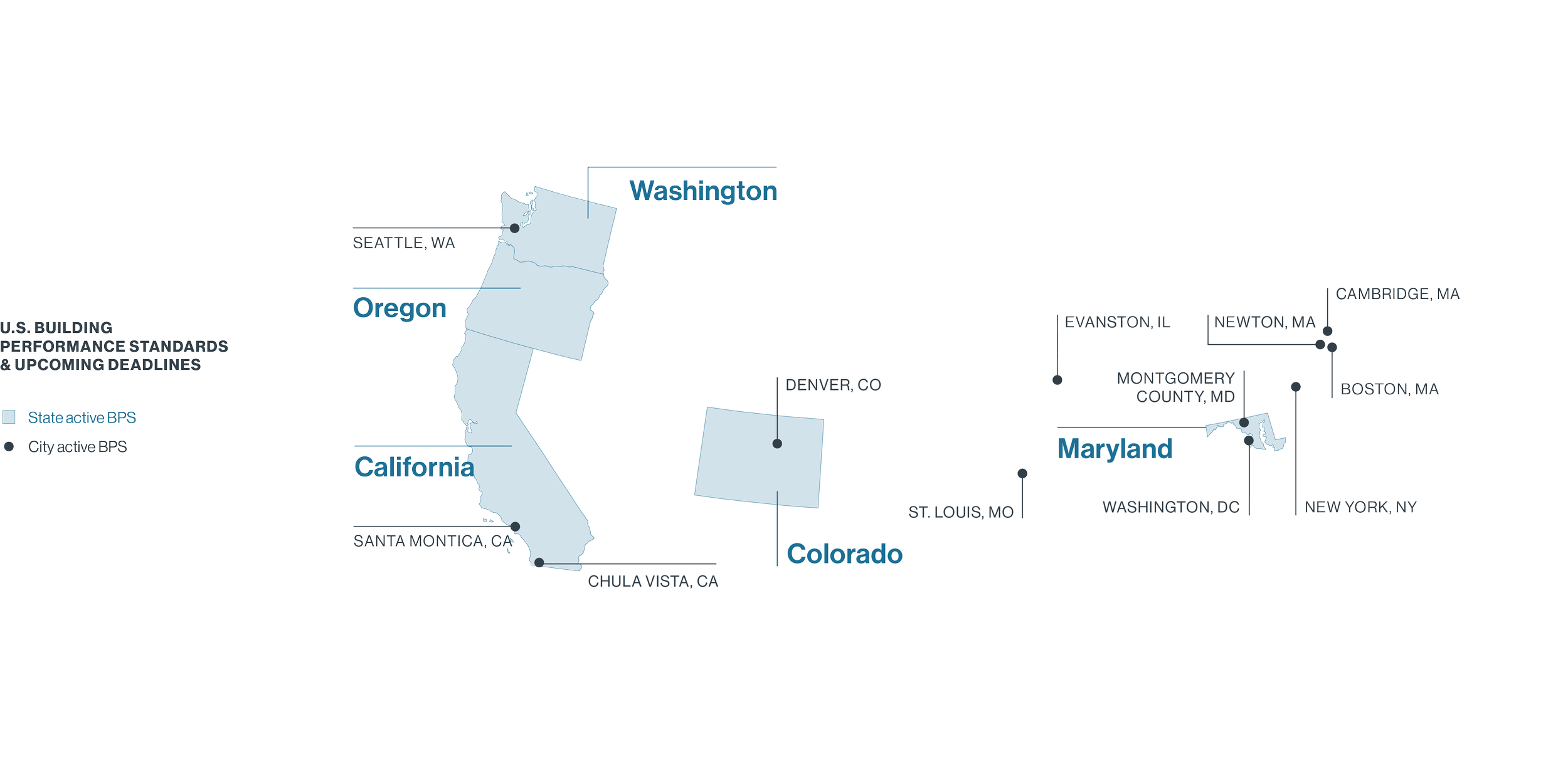

Building Performance Standards

Verdani has services to support ordinance compliance nationwide.

Verdani partners with the Institute for Market Transformation® (IMT) to advance a just energy transition through building performance standards (BPS) analysis and strategic advisory support. IMT also leads collaborations in public policy to drive widespread market shifts in the built environment

Contact us if you have questions or don’t see your state’s ordinance listed below; we have partnerships across the country that can help.

See Where Benchmarking Is Required — State by State (Data last updated Dec. 2025):

-

Montreal, Quebec

By-law Concerning GHG Emission Disclosures and Ratings of Large Buildings

Ontario

Reporting of Energy Consumption and Water Use

Vancouver, British Columbia

Energy and Carbon Reporting

Greenhouse Gas and Energy Limits By-Law

Toronto

Benchmarking

-

Berkeley

Building Energy Saving Ordinance (BESO)

Brisbane

Brisbane Building Efficiency Program (BBEP)

Building Efficiency Program Beyond Benchmarking - Audit & Tune Up Requirements

Chula Vista

Building Energy Saving Ordinance

Building Energy Saving - Audit & Tune Up Requirements

Los Angeles

Existing Buildings Energy and Water Efficiency (EBEWE) - Audit

Existing Buildings Energy and Water Efficiency Program (EBEWE) - Benchmarking

San Diego

Building Energy Benchmarking Ordinance

San Francisco

Existing Buildings Energy Ordinance

San Jose

Energy and Water Building Performance Ordinance

Santa Monica

NEW benchmarking ordinance tentative start in 2026

Statewide

Building Energy Benchmarking Program (AB802)

West Hollywood

NEW benchmarking ordinance tentative start in 2026

-

Aspen

Building IQ - Benchmarking

Boulder

Boulder Building Performance Ordinance

Denver

Energize Denver

Ft. Collins

Building Energy and Water Scoring Program

Statewide

Energy Performance for Buildings

-

Miami

Building Efficiency 305 Benchmarking Program

Building Energy and Water Consumption Benchmarking and Retuning Ordinance

Orlando

Building Energy and Water Efficiency Strategy (BEWES) - Audit

Building Energy and Water Efficiency Strategy (BEWES) - Benchmarking

-

Atlanta

Commercial Building Energy Efficiency Ordinance (CBEEO) - Audit

Commercial Energy Efficiency Ordinance (CBEEO) - Benchmarking

-

Honolulu

Better Buildings Benchmarking

-

Chicago

Chicago Energy Benchmarking Ordinance

Evanston

Building Energy and Water Use Benchmarking Ordinance

Oak Park

Climate Ready Oak Park

-

Indianapolis/Marion County

Thriving Buildings Benchmarking

-

Des Moines

Energy and Water Benchmarking Ordinance

-

New Orleans

NEW benchmarking in 2026

-

Portland

Energy Benchmarking

-

Montgomery County

Building Energy Use Benchmarking

Building Energy Performance Standards (BEPS)

Statewide

Benchmarking and Reporting

Maryland's Building Energy Performance Standards (BEPS)

-

Boston

Building Emissions Reduction and Disclosure Ordinance (BERDO)

Cambridge

Building Energy Use Disclosure Ordinance (BEUDO)

Chelsea

Building Emissions Reduction and Disclosure Ordinance (BERDO)

Lexington

Lexington Benchmarking

Newton

Newton Building Emissions Reduction and Disclosure Ordinance (BERDO)

Statewide

Large Building Energy Reporting

-

Ann Arbor

Energy and Water Benchmarking Ordinance

Detroit

Energy Waste Reduction Benchmarking Ordinance

-

Edina

Efficient Building Ordinance

Efficient Building Benchmarking

Minneapolis

Energy Benchmarking

Statewide

Building Energy Use Benchmarking Program

-

Clayton

Building Energy Awareness Ordinance

Kansas City

Kansas City Energy Empowerment Ordinance

St. Louis

Building Energy Awareness Ordinance

Building Energy Performance Standards

-

Reno

Energy and Water Efficiency Program Ordinance

Energy and Water Efficiency Program (ReEnergize Reno)

(Voluntary) ReEnergize Reno

-

Statewide

Clean Energy Act (CEA) Benchmarking

-

Bedford

Building Health and Performance Law

New York City

The NYC Benchmarking Law (Local Law 84)

Sustainable Buildings NYC (Local Law 97)

-

Columbus

Energy and Water Benchmarking and Transparency Ordinance

-

Portland

Commercial Building Energy Reporting

Statewide

NEW Building Energy Performance Standards

-

Philadelphia

Building Energy Benchmarking

Building Energy Performance Policy

PIttsburgh

Pittsburgh Building Benchmarking Ordinance

-

Providence

Building Energy Reporting Ordinance

-

Austin

Energy Conservation and Disclosure Ordinance (ECAD)

-

Salt Lake City

Commercial Building Benchmarking and Market Transparency (Elevate Buildings)

-

Seattle

Building Tune-Ups

Energy Benchmarking Law

Building Emissions Performance Standards

Statewide

Energy Benchmarking

Clean Buildings Performance Standard

Clean Buildings Performance Standard - Audit Requirements

-

Washington, D.C.

Benchmarking Program

Building Energy Performance Standards and Benchmarking

-

Madison

Building Energy Savings Program

Milwaukee

Milwaukee Efficient Buildings Benchmarking Program

Monitoring Ordinance

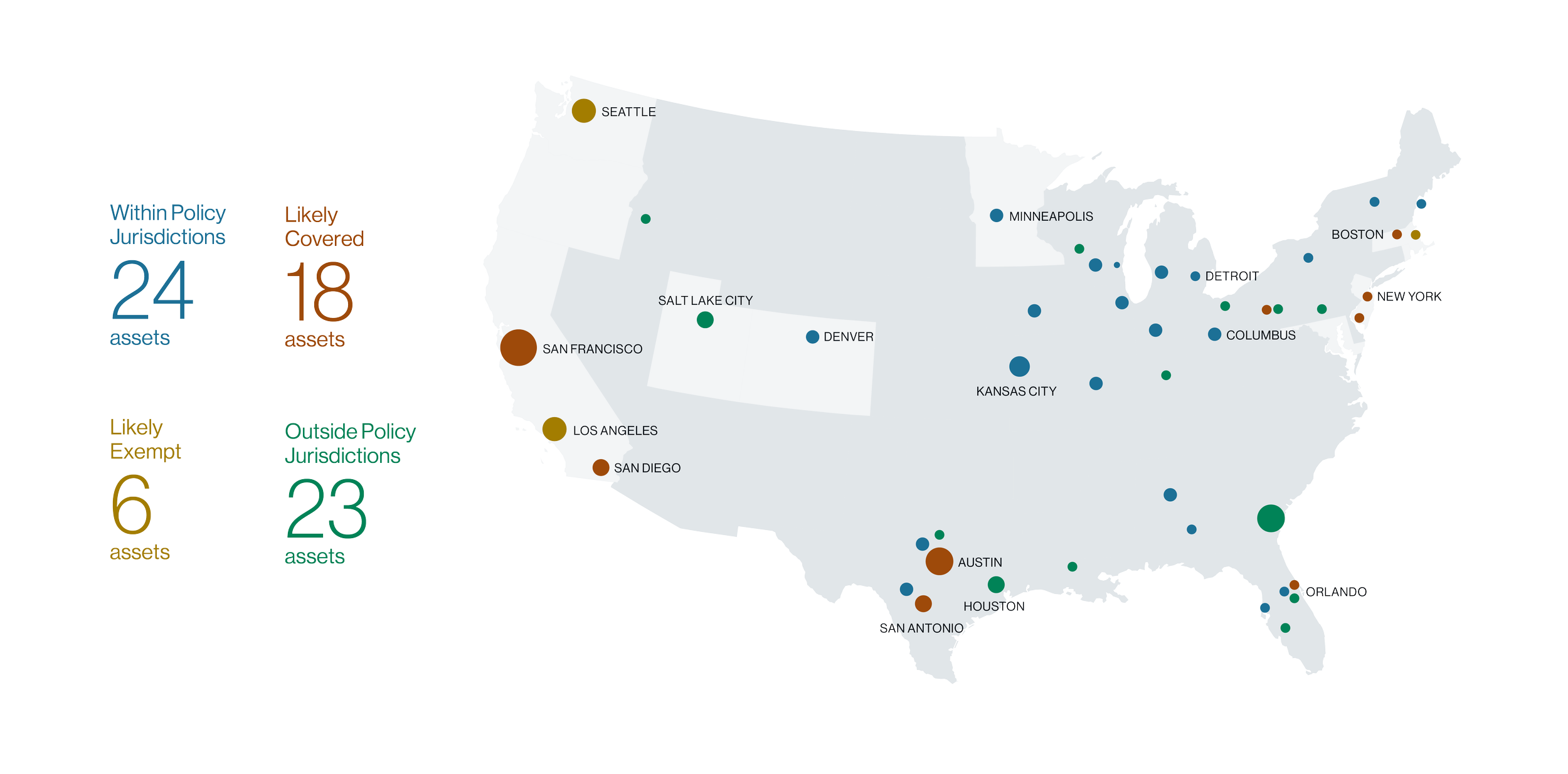

& Regulatory Exposure™

Verdani’s proprietary MORE™ tool empowers clients to proactively manage compliance risk across their portfolios. MORE identifies assets likely subject to benchmarking, audit, or building performance standards — drawing from the real-time Energy Policy Database maintained by IMT. An interactive dashboard delivers visual insights and key metrics, streamlining compliance reviews and enhancing confidence in regulatory alignment.

Depiction of Verdani’s MORE Tool Map Output:

Contact us to learn more about our compliance risk services.

Staying compliant with benchmarking ordinances used to be a challenge for us until we started working with Verdani Partners. Their ordinance tracking services and MORE Tool have been game-changers. They monitor every update and deadline across all jurisdictions we operate in. The accuracy and responsiveness of their team are outstanding. We can now focus on our core operations, knowing we’re fully compliant.

“

Isela Rosales

MANAGING DIRECTOR, GLOBAL HEAD OF SUSTAINABILITY & RESPONSIBILITYBRIDGE INVESTMENT GROUP®